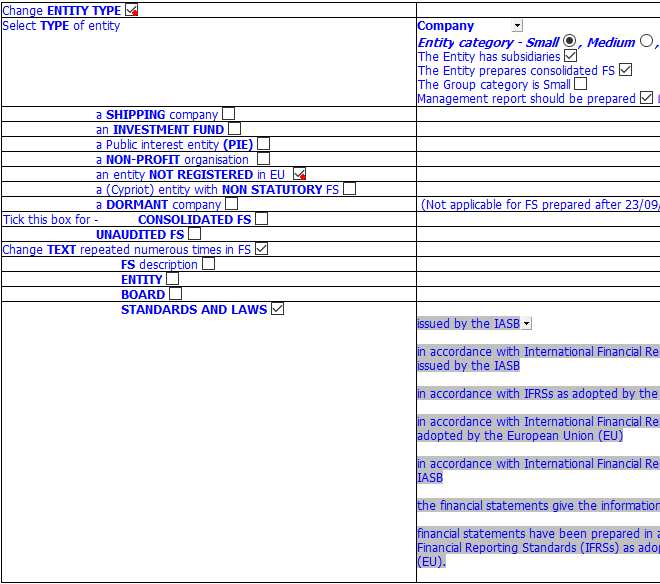

2.10 What is the effect on the financial statements of the selection that the entity NOT REGISTERED in Cyprus?

The following sections will be affected on selecting that the entity is NOT REGISTERED in Cyprus:

Entry table - Change TEXT repeated numerous times in FS

STANDARDS AND LAWS - Laws and regulations are changed so as not to refer to the requirements of the Cyprus Companies Law, Cap. 113.

Auditor’s report

In case the financial statements are for a Branch then this is referred to as ’the Branch’ instead of ‘the Cyprus Branch’

The section ‘Report on other legal requirements’ is skipped

Reference to "Section 34 of the Auditors and Statutory Audits of Annual and Consolidated Accounts Laws of 2009 and 2013" is removed.

Taxation

References to special contribution for defence on notional dividends are removed.

Tax reconciliation part of tax note is skipped.

A line which states that dividends payable to non-residents of Cyprus are not subject to withholding tax is added.

The computations of defence and corporation tax are skipped