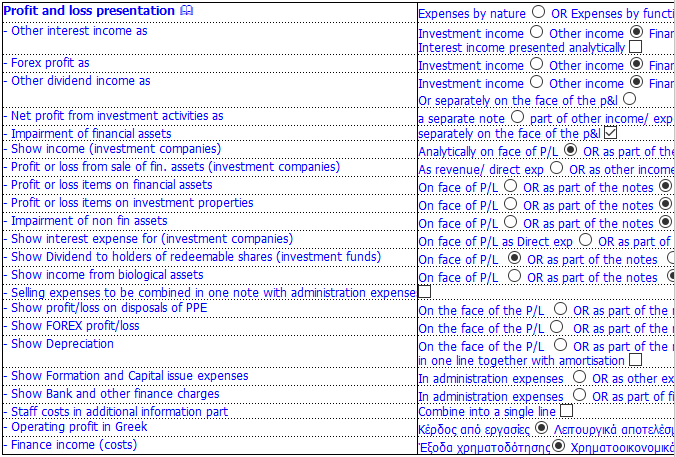

2.50 What are the different profit and loss presentation options and how do these affect the financial statements?

The different options and their effect on the financial statements are explained in the table here below:

Option | Map numbers | Effect on the financial statements |

Profit and loss presentation as a whole |

| Expenses by nature or by function are alternative presentation options of IAS1. Select between the two options the one which is more appropriate for the client’s financial statements |

Other interest income | "6.T.7.1" to "6.T.7.9" | Interest income may be moved between ‘Investment income ‘, ‘Other income’ or ‘Finance income’ |

Forex profit | “6.T.7.15” and “6.T.7.16” | Foreign exchange gains may be moved between ‘Investment income ‘, ‘Other income’ or ‘Finance income’ |

Other dividend income | “6.T.7.10” and “6.T.7.11” | ‘Interest income’ may be moved between ‘Investment income ‘, ‘Other income’ or ‘Finance income’. In addition, there is an option to disclose ‘dividend income on the face of the statement of profit or loss after operating results |

Net profit from investment activities | “5.T.4.11” to “5.T.4.17”, “5.T.4.20” to “5.T.4.23”, “5.T.4.40” to “5.T.4.41”, “5.T.6.11” to “5.T.6.17”, “5.T.6.20” to “5.T.6.29” and “5.T.6.40” to “5.T.6.41” | ‘Net profit from investment activities’ may be presented either as a separate note or as part of other income or other expenses |

Impairment of financial assets | "5.T.4.54" to "5.T.4.57", "5.T.4.60", "5.T.4.63", "5.T.4.70. 5", "5.T.4.80. 5" to "5.T.4.80. 7", "5.T.6.24" to "5.T.6.26", "5.T.6.29", "5.T.6.45", "5.T.6.63", "5.T.6.70. 5" and "5.T.6.80. 5" to "5.T.6.80. 7" | Option to disclose impairment of financial assets on the face of the statement of profit or loss before operating results instead of the notes to the financial statements |

Statement of changes in net assets available for benefits (Provident funds only) |

| Show Statement of changes in net assets available for benefits separate from Statement of changes in net assets |

Interest income (Provident funds only) | “3.Q.5. 1” to “3.Q.5. 3” | ‘Interest income’ may be presented either line by line for each map number on face of the Income statement or as a total on the Income statement and line by line in the notes to the financial statements |

Members contributions (Provident funds) |

| At the beginning or at the end of the Statement of changes in net assets |

Income for investment companies (investment companies) | “3.Q.4. 1” to “3.Q.4. 6” | This option is for investment companies that may want to present ‘Income’ either line by line for each map number on face of the Income statement or as part of the ‘Revenue note’ in the notes to the financial statements |

Profit or loss from sale of financial assets (investment companies) | “5.T.4.11” to “5.T.4.16” and “5.T.6.11” to “5.T.6.16” | This option is for investment companies that may want to show ‘Profit from sale of financial assets’ either as revenue or as other income and loss from sale of financial assets either as direct expense just after revenue or as other expense |

Profit or loss items on financial assets | "5.T.4.11" to "5.T.4.16", "5.T.4.21" to "5.T.4.23", "5.T.4.54" to "5.T.4.57", "5.T.4.60", "5.T.4.62", "5.T.4.63", "5.T.4.70. 1", "5.T.4.70. 5", "5.T.4.80. 1", "5.T.4.80. 5" to "5.T.4.80. 8", "5.T.6.11" to "5.T.6.16", "5.T.6.21" to "5.T.6.23", "5.T.6.54" to "5.T.6.57", "5.T.6.60", "5.T.6.62", "5.T.6.63", "5.T.6.70. 1", "5.T.6.70. 5", "5.T.6.80. 1", "5.T.6.80. 5" to "5.T.6.80. 8" | With this option profit or loss on financial assets may be presented either on face of the Income statement or as part of the ‘Other income’ note |

Profit or loss items on investment properties | "5.T.4.17", "5.T.4.20", "5.T.4.62", "5.T.6.17", "5.T.6.20", "5.T.6.46" | With this option profit or loss on investment properties may be presented either on face of the Income statement or as part of the ‘Other income’ note |

Impairment of non-financial assets | "5.T.4.58", "5.T.4.59", "5.T.4.61", "5.T.4.64", "5.T.6.27", "5.T.6.28", "5.T.6.64" | With this option impairment of non-financial assets may be presented either on face of the Income statement or as part of the ‘Other income’ note |

Interest expense (investment companies) | “6.T.8. 1” to “6.T.8. 9” | This option is for investment companies that may show ‘Interest expense’ either as direct expense just after revenue or as other expense |

Dividend to holders of redeemable shares (investment funds) | “6.T.8. 3” | With this option ‘Dividend to holders of redeemable shares’ may be presented either on face of the Income statement or as part of the ‘Other income’ note |

Income from biological assets | "3.Q.3. 1" to "3.Q.3. 5" | With this option ‘biological assets’ may be presented either on face of the Income statement or as part of the ‘Revenue’ note |

Selling expenses to be combined in one note with administration expenses | All map numbers beginning with "5.T.1" and "5.T.2" | Selling expenses note is hidden and all selling expenses are combined in one note together with administration expenses |

Profit/loss on disposals of PPE | “5.T.6. 7” and “5.T.6. 5” | With this option ‘Profit/loss on disposals of PPE’ may be presented either on face of the Income statement or as part of the ‘Finance costs’ note |

Profit/loss from foreign exchange transactions | “6.T.3. 4”, “6.T.3. 5”, “6.T.7.15” and “6.T.7.16” | With this option ‘Profit/loss from foreign exchange transactions’ may be presented either on face of the Income statement or as part of the note ‘Net profit from foreign exchange transactions’ |

Depreciation | All map numbers ending in “.95” to “.99” | With this option ‘Depreciation and amortisation expense’ may be presented either on face of the Income statement as a total or as part cost of sales or expenses as appropriate for the particular map number.

As a second option the user may select to show Depreciation and amortisation in one line. |

Formation and Capital issue expenses | “5.T.6. 3”, “5.T.6. 3. 1” and “5.T.6. 4” | With this option ‘Formation and Capital issue expenses’ may be presented either within ‘Administration expenses’ within ‘Other expenses’ which is the default presentation |

Bank and other finance charges | “6.T.3. 1” to “6.T.3. 3” | With this option ‘Bank and other finance charges’ may be presented either within ‘Administration expenses’ within ‘Finance costs’ which is the default presentation |

Staff costs | “4.R.1.11” to “4.R.1.17” “4.R.3. 2” to “4.R.3. 6” “5.T.1. 1” to “5.T.1. 5” “5.T.2. 1” to “5.T.2.12” and “5.T.3. 1” to “5.T.3.11” | Combine each map grouping into one line as staff costs in additional information part of the FS document. |

Description of 'Operating profit' in Greek |

| Choice between ‘Κέρδος από εργασίες’ and ‘Λειτουργικά αποτελέσματα’ |

Description of 'Finance income (costs)' in Greek |

| Choice between ‘Έξοδα χρηματοδότησης’ and ‘Χρηματοοικονομικά έξοδα’ |