2.61 A company has interest income from group companies’ part of which is taxed as trading income and part is taxed as interest. How do we account for this in the financial statements template?

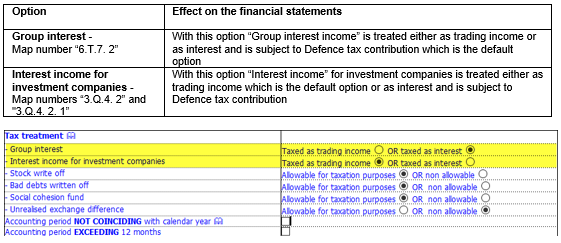

Interest income is taxed either as interest or trading income by option in the entry table of the financial statements for the following mappings:

One option is to use map no. 3.Q.4. 2 and/or 3.Q.4. 2. 1 for the trading part of interest and 6.T.7. 2 for the interest part.

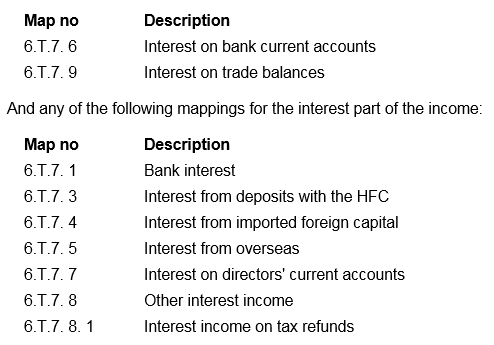

A second option is to use the following mappings which might not be used for the particular client (renamed as appropriate) for the trading part of the income: